|

|

|

| DEAR FUTURE HOME OWNER ... |

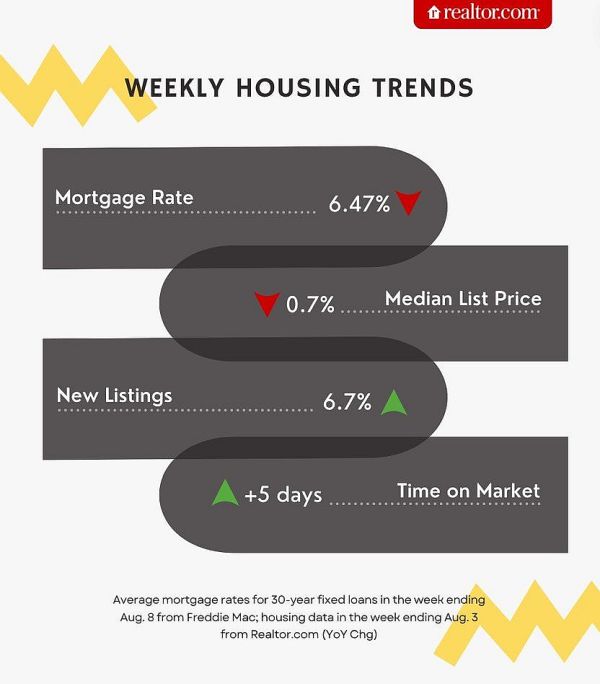

"Mortgage rates plunged this week to their lowest level in over a year following the likely overreaction to a less than favorable employment report and financial market turbulence for an economy that remains on solid footing," Sam Khater, Freddie Mac's chief economist, said in a statement. "The decline in mortgage rates does increase prospective homebuyers' purchasing power and should begin to pique their interest in making a move.

"This drop in rates of late is significant enough to translate into "real savings" on a monthly housing payment, according to Realtor.com® Chief Economist Danielle Hale in a recent analysis. However, she notes that "buyer traffic and market competitiveness may amp up if mortgage rates remain low," adding that "recession worries could limit some of the potential gains."

With serious financial changes afoot, what will the housing market look like as the summer turns into fall? Here"s a snapshot of the latest housing market data and what it means for homebuyers and sellers in our latest installment of "How's the Housing Market This Week?" |

(courtesy Realtor.com) |

Now is the time to start collecting all the paperwork and check your financing, credit report and make an appointment with your Realtor. I am here to help you finding the right property with the best possible financing. Builders are still giving great buyer incentives, 3.75% interest rate fixed for 30 years and most if not all closing cost paid. |

Give me a call at 512-585-0131 to set an appointment.

Many things have changed and have taken effect 08/13/2024.

I am looking forward to hearing from you.

|

|